Roth ira early withdrawal calculator

Learn About 2021 Contribution Limits Today. If youre still saving for retirement you could also.

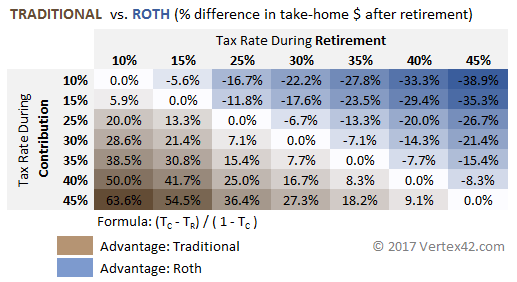

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Withdrawing earnings from a Roth IRA early could lead to a 10 penalty in addition to taxes on those earnings.

. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Learn About 2021 Contribution Limits Today. Ready To Turn Your Savings Into Income.

In this example multiply 2500 by 01 to find the penalty equals 250. Buy Gold Investments from Top US Providers. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

Discover The Benefits Of A Roth IRA. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. When a Roth IRA owner dies some distribution rules can apply to whoever inherits that Roth IRA.

Individuals will have to pay income. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Simply put you intend to.

This tool is intended to show the tax treatment of distributions from a Roth IRA. Ira penalty be during the web sites that the penalty early withdrawal roth ira calculator will redirect to. In many cases youll have to pay federal and.

You cannot deduct contributions to a Roth IRA. Right here the number one location for financial education Im going to look. Simply take the entire.

A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA. If you have a Roth IRA you are free to withdraw your original contributions. Roth IRA Early Withdrawal Tax Calculator.

Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors. Using this 401k early withdrawal calculator is easy. If you are considering a withdrawal from one of these types of IRAs before age 59½ it will be considered an early distribution by the IRS.

Roth IRA Distribution Tool. For some investors this could prove to. A Roth IRA is totally ineffective if you dont spend the cash in your Roth IRA.

In some situations an early withdrawal may also be subject to income tax or a. Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. Before making a Roth IRA withdrawal keep in mind the following.

Some exceptions allow an individual younger. With a traditional IRA in which you made tax-deductible contributions the calculation is easier. Simply take the entire amount of your early withdrawal and multiply by.

Starting the year you turn age 70-12. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. Reviews Trusted by Over 45000000.

Discover The Benefits Of A Roth IRA. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Presuming youre not around to retire following year you desire growth as well as focused investments for your Roth IRA.

Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Roth IRA Early Withdrawal Calculator. That is it will show which amounts will be subject to ordinary income tax andor.

Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account.

See how a Roth IRA conversion Qualified Charitable Distributions QCDs and taxabletax free withdrawals could affect your current year taxes. Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors. Automated Investing With Tax-Smart Withdrawals.

If you need to tap into retirement savings.

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

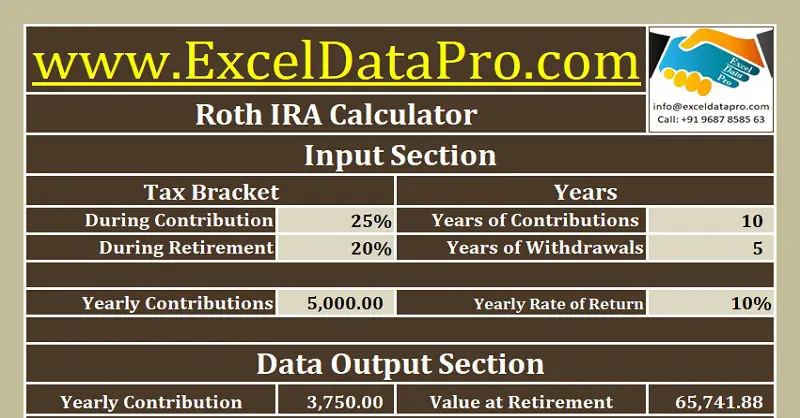

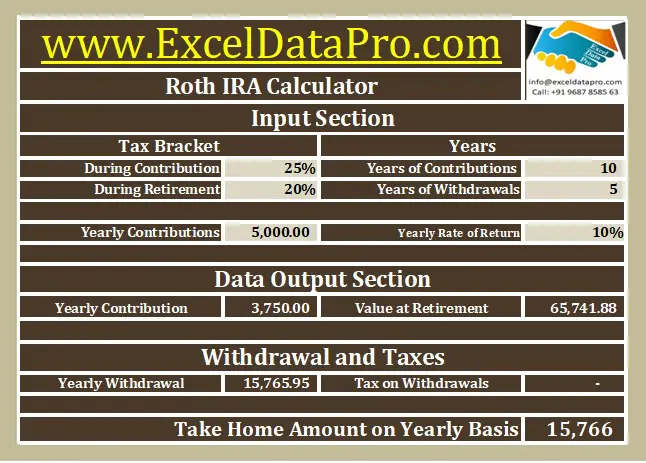

Download Roth Ira Calculator Excel Template Exceldatapro

Nerdwallet Roth Ira Calculator Results Explained With Examples 2022 Youtube

Pin On Financial Independence App

Calculate Your Possible Expenses Upon Retirement Image Source Https Accupaysystems Com Wp Content Uploads 2015 04 Fillin Calculator Retirement Image Sources

Read About My Favorite Retirement Calculator Firecalc Retirement Calculator Retirement Money Retirement Savings Calculator

Ira Withdrawal Calculator Clearance 54 Off Pwdnutrition Com

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

Retirement Withdrawal Calculator For Excel

Roth Ira Calculator Roth Ira Contribution

Traditional Vs Roth Ira Calculator

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Download Free Traditional Ira Calculator In Excel

Download Roth Ira Calculator Excel Template Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro